A Review of the National Forecasts vs the Major Markets Wilkinson Focuses On.

National Market Outlook

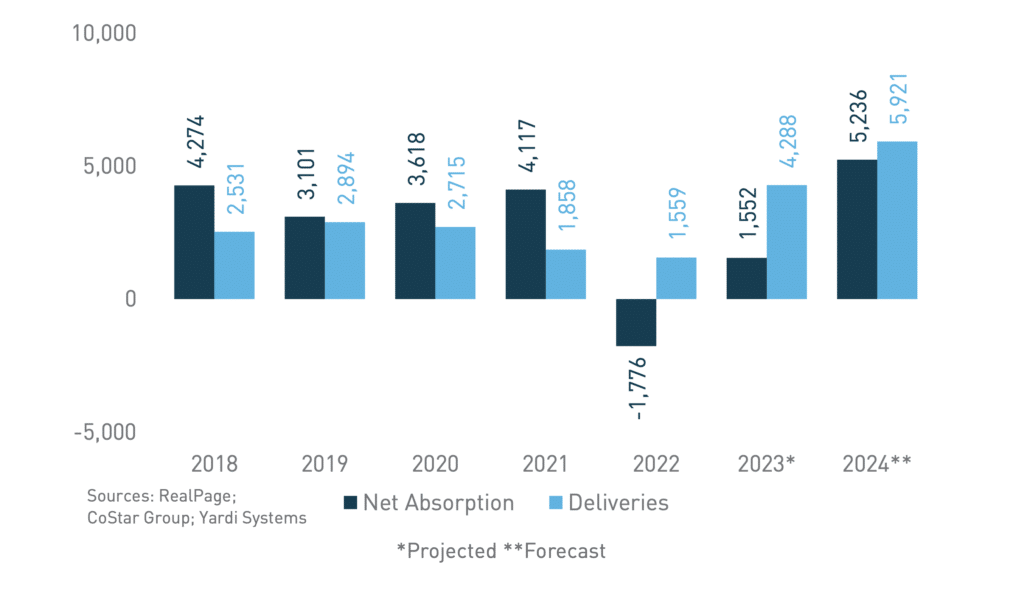

In 2024, the national multifamily market is poised for positive growth, marked by several key indicators. Occupancy rates are expected to rise by 20 basis points to reach 94.5% in Q4 2024, driven by tapping into unmet housing demand. https://berkadia.com/forecast-reports/

Leasing activity is anticipated to surge due to a limited supply of single-family homes for sale and a robust economy, boosting demand for rental apartments.

Monthly effective rent is projected to increase by 3%, reaching $1,882 in Q4 2024, supported by higher occupancy and household income.

The development sector is expected to experience robust deliveries this year, facilitated by prolonged construction timelines and a favorable development environment in recent years. Overall, these factors contribute to a positive outlook for the national multifamily market in 2024.

National Data Berkadia 2024 Forecast Reports

Wilkinson Target Market Outlook

Our acquisition strategy at Wilkinson focuses on three major metropolitan areas in the United States: Atlanta, Indianapolis, and Dallas-Forth Worth. Across our markets, we are seeing a modest decrease in price per unit as inflation is cooling and the market reaches a soft landing. While a decreased PPU may be alarming to investors looking to exit this year, for those planning to purchase and/or hold in 2024, such as Wilkinson, it is also a great opportunity for new acquisitions as we expect the acquisition market to be especially competitive this year. We are confident in the properties we already hold and that they will continue to perform well with an increase in effective rent and occupancy.

Atlanta

While we expect unit prices to decrease and cap rates to increase in Atlanta in 2024, positive trends we will see include growth in occupancy, effective rent, household income, and employment. We expect our Atlanta properties to perform steadily with no significant gains or losses. The outlook is generally favorable, offering stability for investors, with small increases expected. Renewed leases contribute to a slight uptick in occupancy, and Atlanta expects around 38,900 new residents in 2024. Employment growth supports leasing activity, and renting remains more affordable than homeownership in Atlanta. Overall, we forecast a balanced and steady performance in the Atlanta multifamily market.

Economic Landscape

Employment – By December 2024 employment in Atlanta is forecasted to be up 0.6% YOY, and unemployment is forecast to be up 0.6% YOY.

One explanation for the increase in both employment and unemployment could be an expansion of the labor force, where more individuals enter the job market seeking employment. This influx of new participants may contribute to both higher employment and increased unemployment as not everyone immediately secures a job.

During periods of economic transition or structural changes, certain industries or sectors may experience job growth while others face layoffs. This can result in a simultaneous increase in employment in growing sectors and unemployment in declining sectors.

Household Income – The median household income in Atlanta (December 2024 SAAR) is forecast to be $95,156 – up 3.0% YOY.

Rental Market Trends

Effective Rent & Occupancy Rate – In Q4 of 2024 we expect the occupancy rate to go up 0.1% YOY to 92.4% and the effective rent to rise 2.0% YOY to $1,709.

The occupancy rate increase indicates strong tenant demand, stable cash flow, and potential for rent growth or property appreciation. The effective rent increase demonstrates that Atlanta is a strong market and there is improved income potential for property owners and investors.

Net Absorption vs Deliveries

Property Valuation Trends

Price Per Unit & Cap Rates – Price per unit will go down 10.5% YOY for a 2024 average of $172,551. Cap rates will go up 0.3% YOY with a 2024 average of 5.8%

Dallas-Fort Worth

Dallas-Fort Worth’s multifamily market is expected to grow modestly in 2024, with positive trends in employment, household income, effective rent, and occupancy. However, there will be a decrease in the price per unit, and cap rates are expected to rise. Despite a notable increase in new supply, slightly surpassing demand, the market is predicted to remain stable. Dallas-Fort Worth is anticipated to lead the nation in both new supply and net absorption, outperforming Phoenix. This growth, coupled with pressure on the single-family home market, may drive more residents toward renting. Overall, the market outlook suggests stability and promising performance for our properties in Dallas-Fort Worth.

Economic Landscape

Employment – by December 2024 we expect employment in Dallas-Fort Worth to increase 1.0% YOY, and unemployment to remain unchanged at 3.8%.

Household Income – We expect the median household income in Dallas-Fort Worth to be up 2.9% YOY (December 2024 SAAR) at $89,297.

Rental Market Trends

Effective Rent & Occupancy Rate – In Q4 2024 we expect the occupancy rate in Dallas-Forth Worth to be up 0.2% YOY to 93.4% and the effective rent to increase 2.9% YOY to $1,589.

Net Absorption vs Deliveries

Property Valuation Trends

Price Per Unit & Cap Rates – Price per unit will go down 8.5% YOY with a 2024 average of $155,451. We expect cap rates to increase by 0.2% YOY for a 2024 average of 5.5%.

Indianapolis

In 2024, the multifamily market in Indianapolis is positioned as one of the most affordable among its neighboring metros. Driven by the city’s growing economy and diversifying job market, the region is expected to experience increases in both employment and unemployment. Despite a slight dip in occupancy rates due to a high volume of new supply, we expect a modest increase in the average effective rent in Indianapolis. With an anticipated surge in both supply and demand, the market remains robust with strong net absorption and a projected 1.6% annual increase in household formation. Household income is poised to rise, contributing to the overall positive outlook. Overall, the multifamily market in Indianapolis exhibits favorable conditions for growth and investment opportunities in 2024.

Economic Landscape

Employment – By the end of 2024 we expect employment to be up 0.5% in Indianapolis, and unemployment to increase 0.5% YOY to 3.8%.

Household Income – We expect the median household income in Indianapolis to go up 2.6% YOY to $82,355 (December 2024 SAAR).

Rental Market Trends

Effective Rent & Occupancy Rate – By Q4 2024 we expect the occupancy rate to go down 0.1% YOY to 93.5% and the effective rent to increase 3.3% YOY to $1,299.

Net Absorption vs Deliveries

Property Valuation Trends

Price Per Unit & Cap Rates – The price per unit in Indianapolis will go down 8.0% YOY to a 2024 average of $133,609. Cap rates will increase by 0.3% YOY for a 2024 average of 6.0%.

Summary

National Market Outlook:

- Positive growth is expected in the national multifamily market in 2024.

- Occupancy rates to rise to 94.5% in Q4 2024.

- Leasing activity to surge due to limited supply of single-family homes.

- Monthly effective rent is projected to increase by 3% to $1,882 in Q4 2024.

- Robust deliveries expected in the development sector.

Wilkinson Target Market Outlook:

- Wilkinson focuses on Atlanta, Indianapolis, and Dallas-Fort Worth.

- Modest decrease in price per unit (PPU) in Wilkinson’s target markets.

- Atlanta: Stable performance expected with slight occupancy and effective rent increases.

- Dallas-Fort Worth: Modest growth anticipated despite increased supply.

- Indianapolis: Affordability and growth opportunities highlight the market’s positive outlook.

Economic Landscape:

- Employment is expected to increase modestly across all markets.

- Household income is forecasted to rise, contributing to positive market trends.

- Rental market trends indicate modest growth in occupancy rates and effective rent.

Property Valuation Trends:

- Price per unit (PPU) to decrease slightly across all markets.

- Cap rates to increase slightly in most markets, reflecting market adjustments.

Sources:

- National Data Berkadia 2024 Forecast Reports

- Atlanta Data :https://properties.berkadia.com/2024-forecast/p/5

- Dallas Fort Worth Data https://properties.berkadia.com/2024-forecast/p/9

- Indianapolis Data – Berkadia 2024 Market at a Glance chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://berkadia.com/wp-content/uploads/2024/01/Berkadia-2024-Forecast-Indianapolis-multifamily-research.pdf