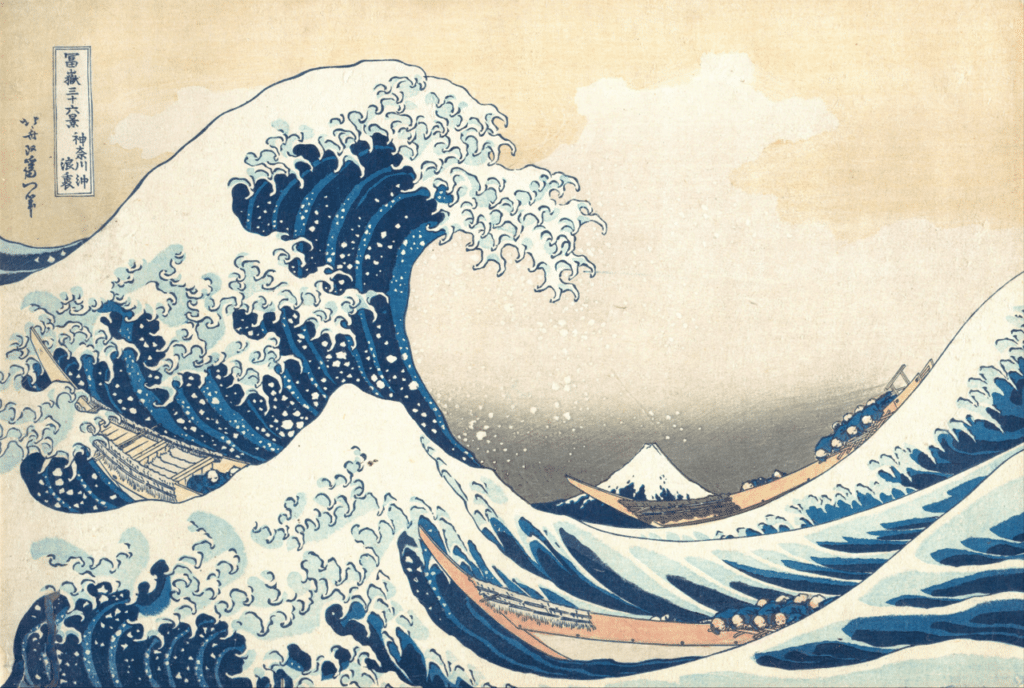

Waiting for the Wave of Distressed Property Investment Opportunities

Just a few years ago, the pandemic crisis hit. Businesses shut down. Capital markets alternated between frenzy and freezing. Concern over widespread economic collapse ran rampant. Fear of a dramatic downturn in real estate values was top of mind for many investors. But for many who experienced prior downturns, that fear was overshadowed by the hope of a tidal wave of great investment opportunities emerging out of those troubled waters. During the recent crisis, there were relatively short periods of time when real estate investors were able to scoop up some great buys in some asset classes like hospitality and office. However, for multifamily investors, the tidal wave of great buys never really materialized. Although there were ripples of some unique multifamily buying opportunities, the demand continued to outpace supply, rent outstripped inflation, and overall valuation pricing continued outperforming prior periods.

Signs of the Tsunami on the Horizon

Post-pandemic, our economy recovered relatively quickly, and the wave of distressed property investment opportunities was smaller and shorter than many expected. Once again in 2023, we find ourselves at an inflection point where government economic stimulus has run its course, inflation has run rampant, and rapidly rising interest rates are causing many to once again ponder the possibility of a tsunami of great investment opportunities on the horizon.

It seems inevitable that there will be an increasing number of distressed property challenges in 2023 as many assets have rate caps that expire or need to refinance and cannot source rates and loan-to-value ratios in line with original business plans. The question seems to be, when will the distress happen and how extensive will it be?

We’ve just come out of 15 years of relatively low interest rates, and strong risk-adjusted yields attracted more and more investors to real estate. Many real estate funds started to accumulate significant amounts of capital, often with groups that didn’t have a ton of experience in real estate. As all that capital sought a place to invest, demand for new opportunities shot up which put further upward pressure on pricing. For multifamily real estate, cap rates reached a generational low in the 3’s and 4’s with 60-70% low-cost leverage that still produced an acceptable yield.

Rising interest rates and cap rates are now putting significant downward pressure on property valuations. Some loans that originated in the last couple of years with a 60% loan-to-value are now approaching 90% or more loan-to-value. If the lender wants that loan paid down or paid off, someone has to invest more capital or that property ends up as a distressed asset and a potentially great investment opportunity for someone else.

Imagine paying 4-5% interest on a $23-30 million loan and when your rate cap expires or you have to refinance, your rate goes up to over 7%. That’s a hit of $60-65k a month on an asset that may have been barely producing a net yield each month at 4-5% interest. Certainly, some properties won’t be able to drive rents enough to cover this additional interest expense, along with all the other expenses that continue to increase from the persistent inflationary pressures.

Will the Wave Ever Hit Shore?

Inflation and rising interest rates are just some of the indicators that seem to send off tsunami warning sirens boding well for the potential tidal wave of great investment opportunities. Here is the challenge: we’ve been saying this for months now and there hasn’t been a flood of challenged properties yet. The reality is that although interest rates have nearly doubled in recent months, they are still historically low. Pricing is starting to adjust to make it possible for some deals to still underwrite to produce a reasonable yield. In addition, the ongoing supply and demand fundamentals still push toward relatively strong valuation stability both from consumers and investors. In most markets, the growing consumer demand for rental housing is likely to persist stronger than the supply can keep up, and the growing investor demand for rental housing continues to be greater than the investment opportunities available.

There has yet to be a flood of troubled assets creating that wave of great investment opportunities, at least not yet. Some would say it’s too early to predict a wave of distress this year, that it’ll be two or three more years until we see the full impact of loans that were originated 3-5 years ago with rate caps or maturities coming due, and unable to recapitalize at terms that work with the original acquisition price and underwriting. Some postulate the next few years are the period where recaps just won’t work and investors and lenders will take a loss. Yet we also don’t know what the economic conditions will look like in a few years. Maybe interest rates and cap rates will move back in line toward original underwriting and divert that potential future storm.

The truth is that if the supply and demand ecosystem is strong, as it is in multifamily, forecasts of huge waves seen on the horizon rarely culminate in the tidal wave on the shore.

There’s no question that 2023 will contine to be a very interesting year. At a minimum, these unknowns will cause a fair amount of paralysis in the market. Deals that would have otherwise sold are dead in the water because sellers aren’t yet ready to drop value expectations in line with what buyers are expecting. Billions of dollars are on the shore waiting to be launched at a better or more certain time. Current indications are that the Fed will need to continue raising interest rates and many lenders will continue to be more cautious and conservative in their terms. Is any of this worth holding your breath hoping that there will be a flood of troubled assets waiting to be scooped up?

What if There is No Wave?

I am seriously questioning whether that tidal wave of distressed properties and extraordinary buying opportunities in multifamily real estate will ever exist, this year or for years to come. It didn’t come as a result of the pandemic-induced recession and it may not come as a result of Fed-induced disinflation or recession. Sure, there will always be those unique opportunities that present fantastic buys, and if anyone can find those needle-in-a-haystack opportunities to buy right and create great value, it’s us. The reality is that the strength of the overall dynamics of the multifamily asset class continues to bode well for sound investments now and for years to come.

Most markets are experiencing decelerating rent growth, but that is simply adjusting the 2023 rent growth forecasts closer to historical averages and closer to the low single-digit growth we forecasted in our underwriting. Whether we experience a recession or a soft landing it seems likely that rent growth in favorable markets will continue at some reasonable single-digit level.

Regardless of the recent slowdown, the fundamentals within multifamily remain very strong.

The fact is, there is still a national housing shortage and rising mortgage rates are pushing even more would-be homeowners into the rental market, creating a larger pool of renter demand. With the relatively strong employment market, wages are expected to continue to increase and support reasonable rent increases. Overall, the big tidal trends in multifamily are likely to overcome the current headwinds that might otherwise cause that tidal wave of distress.

Create Your Own Wave–Buy Right, Create Value, Manage Well

What that means for us, is that we continue to do what we have done for 30 years. In all market cycles, we look for opportunities to buy right, create value and manage well for long-term sustainable success. At some points in the market cycle, it is easier than others to “buy right”. In seasons like this, we may need to underwrite over 100 deals to find one that meets our criteria, but the basics remain the same. Find a property that we can buy at a price that with current interest rates, conservative underwriting standards, and a compelling business plan, enables us to confidently project a return that is in line with our investment expectations. Once we find that opportunity to buy right, rather than waiting for market conditions to produce value, we create value by driving operational performance or capital improvements. Ultimately, it is day-in-day-out diligent management of every aspect of the investment that produces the consistency of investment success that we’ve enjoyed for many years. So rather than waiting for that flood of great opportunity in the ocean of uncertainty, we stick with the fundamentals to build our own wave pool, creating value one property at a time.