The skies appear to be clearing. What lies ahead for multifamily investing in 2024?

While 2022 started strong, with multifamily valuations white hot driven by historically low commercial lending rates, further fueled by high demand for highly profitable passive investments offered by institutional and private investors, by March the Federal Reserve Board stepped in to dampen skyrocketing inflation. While deals that had been in the queue got done, buyers were becoming cautious and by September of the same year, transactional volume rapidly slowed as promising deals fell apart as quickly changing economic potential was misaligned with investors’ expectations.

As interest rates expanded, so did cap rates, along with increased pressure on the economic performance of prospective acquisitions. Viable acquisition valuations represented a significant reduction from the all-time highs of early 2022.

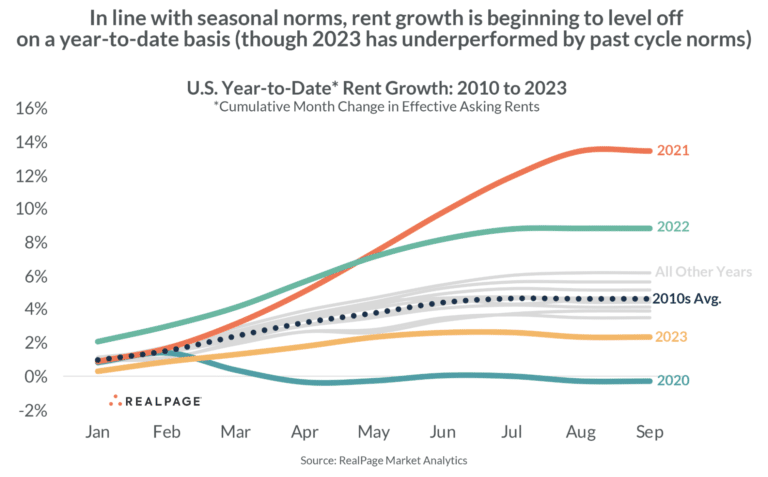

Likewise, in 2021 and 2022 some of the largest rental rate growth on record was met with resistance in mid-2022-2023, with rent growth rates, however, returning to more average growth levels.

We have not seen rates expand so rapidly since the 1980’s. Since that time, institutional quality multifamily investments have surged, with larger REITS fueled by private equity and pension investors alike contributing record amounts of capital to core, core plus, and value-added properties.

Market Trends & Forecasts

In 2023, the multifamily markets navigated cautious waters as cap rates experienced a gradual increase, while interest rates remained elevated and volatile, resulting in tight cap rate spreads. The Federal Reserve’s measured decision-making reflected in a 100-basis-point total increase in the fed funds rate, a notable contrast to the substantial 425-basis-point leap observed in 2022. Despite these challenges, the anticipation for 2024 suggests a soft landing for the market. Interest rate stability is expected to be a key factor contributing to a more balanced and predictable environment, potentially fostering increased transaction volume in the multifamily sector. The careful approach taken by the Federal Reserve and the alignment of interest rates with nominal growth rates signal a measured trajectory for the real estate market in the coming year.

Loan Rates

In 2024, the 10-year Treasury rate is expected to align with the nominal growth rate of 4% by the end of the year. According to Marcus & Millichap, the Federal Open Market Committee (FOMC) chose to maintain the Fed funds rate at the lower bound of 5.25%, signaling a cautious approach to decision-making. This decision follows a 100-basis-point increase in the fed funds rate in 2023, a considerably smaller leap compared to the 425-basis-point increase in 2022. Chairman Powell indicated that the majority of FOMC members believe the Fed funds rate is at or near its peak in the current cycle, acknowledging the risks associated with prolonged elevated rates.

This stance by the Federal Reserve immediately impacted the 10-year Treasury rate, with expectations that it will contract to 4% by mid-late 2024. This reduction in the Treasury rate is significant as it forms the basis for establishing mortgage rates, leading to projections of 5.9-6.1% for senior mortgages. Additionally, there is a further projection that the 10-year Treasury rate will dip to 3.5% by late 2024, which could have positive implications for borrowing costs and investor activity in the real estate market.

Loan Maturities

The impending loan maturities in 2024 and 2025 present potential challenges for multifamily property owners who acquired their assets during times of more favorable loan terms and higher valuations. The era of better loan terms is now in the past, marked by expanded interest rates and reduced loan proceeds. In the current market scenario, even if a property’s value remains consistent with its acquisition value, a refinancing effort will likely necessitate additional capital from the owner due to diminished available proceeds. Furthermore, the decline in valuations as a result of expanding cap rates adds complexity to refinancing, potentially requiring owners to bring in extra funds to close the deal.

The Mortgage Bankers Association highlights that a substantial $682 billion of multifamily loans will mature between 2023 and 2025, with an estimated $322 billion of these loans carrying loan-to-value ratios of 80 percent or higher, according to Newmark’s research team. This situation could lead to increased financial distress across the industry, particularly in bank and debt fund lending, which collectively account for over half of the multifamily debt maturing in the coming years. While extension options may provide a temporary buffer, the industry is likely to witness varying levels of distress as stakeholders must raise more capital or sell to avoid foreclosure.

Transactional Volume

After a significant market pause in mid-2022 and throughout 2023, we expect increased transaction volume in the multifamily real estate sector in 2024. Contrary to some predictions of an enormous wave of opportunity, the market is currently witnessing multiple offers for the right assets when priced appropriately. There is a notable resurgence in capital demand, prompting sales driven by various catalysts such as refinancing, addressing underperforming properties, and strategic considerations regarding negative leverage. Investors are evaluating the potential for growth and seeking creative solutions to navigate the market landscape. The multifaceted challenges are expected to be addressed with problem-solving capital, albeit at a higher cost than traditional sources. However, the return to pre-pause transaction volumes is anticipated to be gradual, requiring time for market dynamics to fully recover.

Many transactions executed between 2020 and 2022 were financed with short-term, floating-rate debt, leading to impending loan maturities or costly interest rate cap extensions (Globest). This is expected to stimulate transaction activity as investors navigate financing challenges. The prolonged period of investor price discovery due to significant interest rate volatility is anticipated to subside as interest rate expectations stabilize. The bid-ask spread between buyers and sellers is expected to narrow, further contributing to heightened transaction volumes in 2024.

The Mortgage Bankers Association (MBA) forecasts a 26% increase in lending transactions for all asset types, totaling approximately $559 billion in 2024, with a 19% increase specifically in multifamily transactions amounting to $339 billion. Freddie Mac’s 2024 Multifamily Market Outlook aligns with these expectations, foreseeing stability in interest rates and cap rates, fostering an environment conducive to increased transaction volumes. Higher transactional volumes suggest enhanced ease in buying and selling properties, potentially influencing price trends and offering investors more opportunities for diversification in an increasingly competitive market.

Multifamily Supply & Demand

The year 2023 witnessed an improvement in apartment demand, driven by robust job growth and a positive shift in consumer sentiment. While job growth is expected to slow in 2024, the achievement of an economic “soft landing” so far suggests momentum for household formation.

However, the 2024 forecast is not without potential headwinds. The resumption of federal student loan repayments poses a concern, potentially impacting the financial allocations of American households. Yet, market-rate metrics, such as the still-balanced median rent-to-income ratio, provide a mitigating factor in addressing these broader concerns.

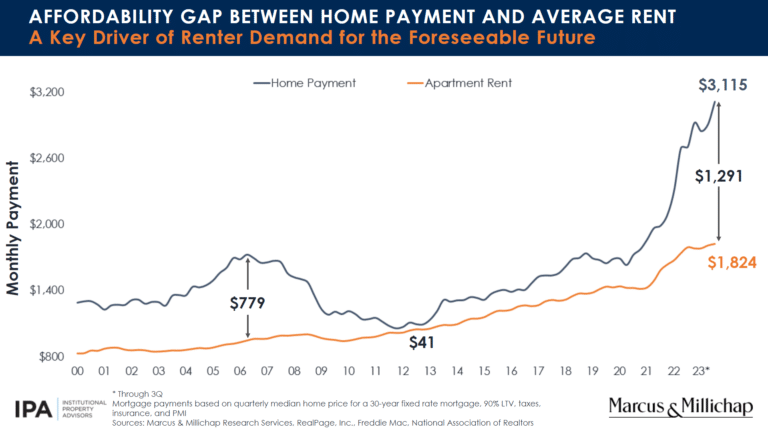

A critical factor influencing the 2024 forecast is the supply side of the equation. With approximately 1 million apartment units still under construction, the market anticipates a banner year in terms of realized apartment deliveries (RealPage). However, the performance at the metro level is expected to vary, with generally slower-moving secondary or tertiary markets outperforming those with high rent growth in previous years and now facing significant new supply challenges. Despite short-term supply headwinds, the multifamily market’s long-term trajectory remains positive, supported by the overall housing shortage, a costly for-sale housing market, and the next generation of renters entering prime renter age (Freddie Mac).

As we consider the multifamily housing market outlook in 2024, it’s vital to closely analyze key performance indicators. Occupancy rates, leasing activity, monthly rent growth, and ongoing development projects are integral elements that significantly impact the intricate balance of supply and demand in this dynamic market landscape.

Occupancy

National multifamily occupancy rates are a crucial indicator in the real estate sector, providing insights into economic health, market supply and demand dynamics, and investor sentiment. These rates serve as benchmarks for assessing market competitiveness and influencing property valuations, lending decisions, and investor strategies. Changes in national occupancy rates can reflect economic cycles, impact tenant and landlord negotiations, and inform stakeholders about policy and regulatory impacts.

According to RealPage, the national multifamily occupancy rate has stabilized at 94.5%. Although there has been a slight decrease of 50 basis points from the beginning of 2023, this is notably less than the 190 basis points contraction observed in 2022. The 94.5% occupancy rate is only 20 basis points below the 2010s average, indicating a trend toward market normalization. RealPage suggests that demand is expected to play a significant role in keeping 2024 occupancy rates consistent with historical norms, hovering in the lower 94% range at a national level. While concerns exist regarding the potential impact of new apartment deliveries on occupancy rates, factors like resident retention mitigate the likelihood of a significant contraction unless an unforeseen event severely affects demand.

Leasing Activity

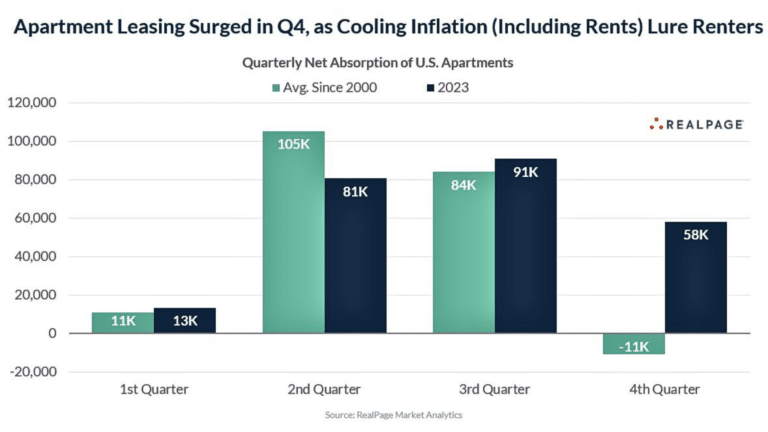

A shortage of single-family homes and a strong economy are driving increased demand for rental apartments. Apartment leasing saw a significant surge in the fourth quarter, with renters drawn to the market amid cooling inflation. The limited availability of single-family homes is prompting more individuals to opt for rental apartments, highlighting the impact of economic conditions on the rental sector.

Monthly Rent Growth Forecasts

We approach the 2024 monthly rent growth outlook with cautious optimism in light of various market factors. According to Berkadia’s 2024 National Outlook, a rise in occupancy and household income is projected to contribute to a 3% year-over-year increase in national monthly effective rent, reaching $1,882 in Q4 2024.

Although some markets may experience flat or declining rent growth, our Chief Investment Officer at Wilkinson, George Waymire, forecasts an average of 2.5% rent growth in our markets, with our properties expected to outperform local market averages. Despite this positive outlook, Freddie Mac injects a note of caution, anticipating muted growth in 2024 due to a continued high rate of new supply entering the market, keeping rent growth below long-run averages and vacancy rates above. Our strategic approach involves navigating this landscape and positioning our properties to outperform and seize growth opportunities in specific markets.

Development

Apartment Deliveries

The forecasted peak in multifamily housing deliveries in 2024, as predicted by Yardi Matrix, carries significant implications for investors. With housing starts reaching decades-long highs and Yardi anticipating 1.5 million units delivered by 2025, certain markets such as Austin, Nashville, Charlotte, Orlando, Raleigh, Phoenix, and Tampa are expected to experience apartment completions exceeding 3.5% of their total stock.

Approximately 1 million apartment units are currently under construction, with a steady decline observed in recent quarters. Despite this decline, 2024 is anticipated to be a standout year, with over 600,000 market-rate multifamily units expected to be completed, marking the highest realized apartment deliveries in the past four decades (RealPage). RealPage further notes that, according to their data, the national monthly delivery rate in 2024 is estimated to be an impressive 50,000 to 55,000 units.

This surge in supply, surpassing sustainable demand trends, is likely to exert upward pressure on vacancy rates and downward pressure on rents. Notably, in most of these markets, the rent-to-income ratio already exceeds 30%, raising concerns about affordability. For investors, the implications include a slowdown in apartment deliveries, with the pace falling behind additional demand. While occupancy is expected to experience modest growth, rent growth is anticipated to settle at a more “normal” rate of 3%. The meteoric growth and increased valuations witnessed in recent years are projected to decelerate to more sustainable levels (Viewpoint 2024.pdf – irr.com).

Pipeline

In 2024, the multifamily development pipeline is characterized by a notable shift in dynamics, with more projects reaching completion than initiating. Assuming a stable economy, the market is expected to transition from a phase of supply exceeding demand in 2023-2024 to a scenario where demand surpasses supply in 2025-2026, possibly extending into 2027. This shift could result in a significant impact, leading to a decrease in vacancy rates and a rebound in rents. The projection aligns with the observation that, despite deliveries hitting a peak, unit starts have declined to approximately 25,000 units per month. This downward trend is attributed to a pullback in construction loans and developments that are economically unfeasible. Although the full impact may not be evident in 2024, the positive repercussions on apartment fundamentals are expected to materialize in 2025 and beyond, favoring owners and operators in a low-supply environment (RealPage).

At Wilkinson, we remain optimistic about the long-term supply and demand dynamics in the multifamily market. Our strategic focus involves identifying the best properties in prime locations, aligning with our commitment to long-term investment success. Given the uncertainties in exit values, we are placing a greater emphasis on core-plus investments over value-add strategies. We anticipate a competitive acquisition market this year, and we are prepared to navigate the challenges by employing careful analysis and a disciplined approach. As we move forward into 2024, our commitment to excellence, coupled with a keen understanding of market trends, positions us to thrive in a dynamic and evolving multifamily landscape.

Summary

Market Trends & Forecasts –Despite challenges including rising interest rates and tight cap rate spreads in 2023, the market is anticipated to have a soft landing. Interest rate stability is expected to foster increased transaction volumes in 2024.

Loan Rates and Maturities – The Federal Reserve’s cautious approach is expected to stabilize interest rates by aligning them with nominal growth rates. However, impending loan maturities in 2024-2025 present challenges for property owners due to reduced loan proceeds and increased refinancing complexities.

Transactional Volume – After a pause in mid-2022 and throughout 2023, increased transaction volumes are expected in 2024, driven by various catalysts such as refinancing and strategic considerations. Financing challenges and interest rate volatility may stimulate activity.

Multifamily Supply & Demand – Apartment demand improved in 2023, driven by job growth, but potential headwinds include the resumption of federal student loan repayments. Approximately 1 million apartment units are under construction, impacting supply dynamics.

Occupancy and Leasing Activity – The national multifamily occupancy rate has stabilized, indicating market normalization. Increased demand for rental apartments due to a shortage of single-family homes is influencing leasing activity.

Monthly Rent Growth Forecasts – Rent growth is projected to increase year-over-year, but at a more muted rate due to continued high new supply levels.

Development – Apartment deliveries are expected to peak in 2024, potentially impacting vacancy rates and rents. The development pipeline is shifting, with more projects reaching completion than initiating, leading to expectations of decreased vacancy rates and rent rebounds in the future.